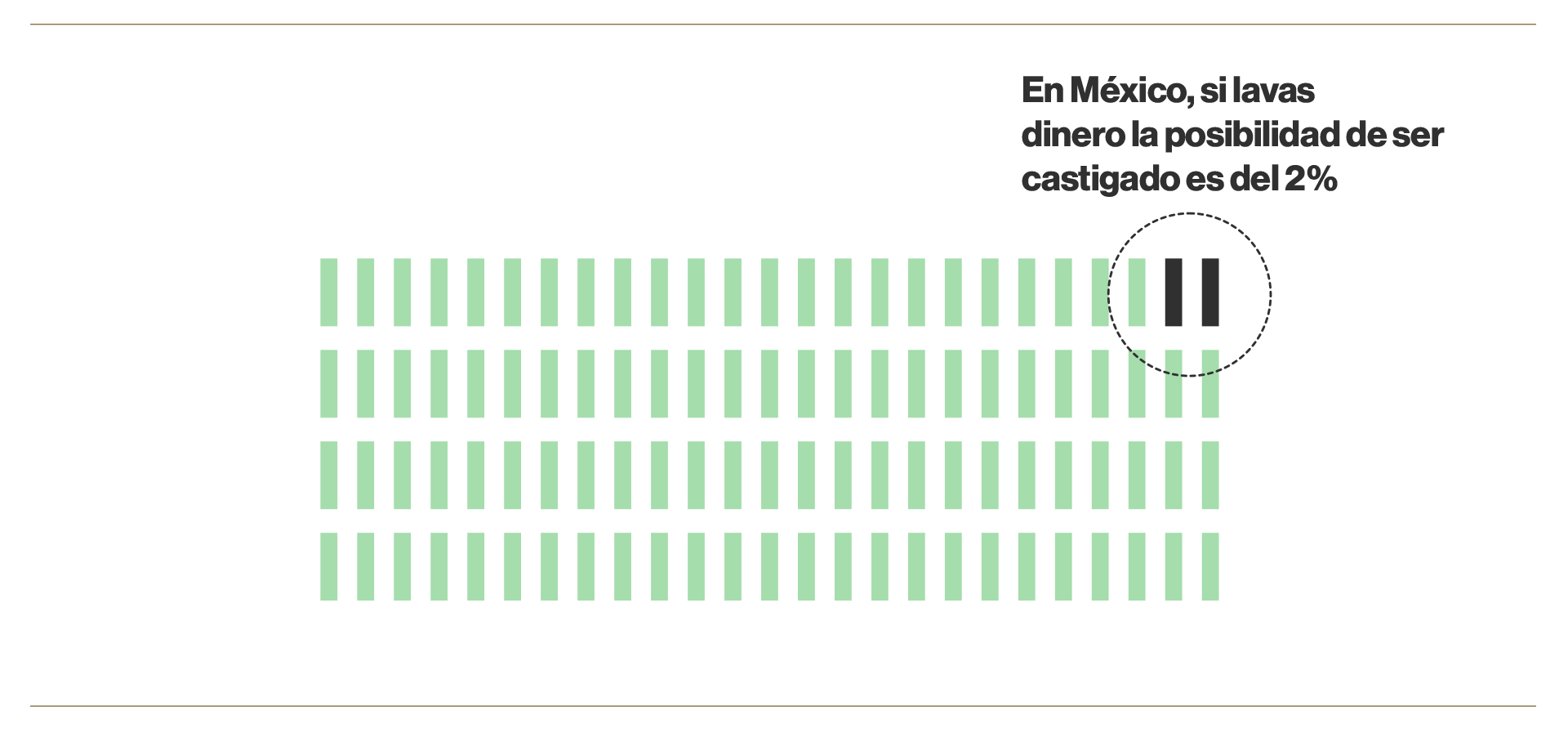

Mexico is a great money washer. Official figures from the Attorney General’s Office (FGR) reveal that the possibility of a person being punished for laundering money is 2 percent.

In Mexico, it is possible to launder money without fear of being prosecuted by the courts. The banking transactions of large amounts, cash deposits for millions of dollars, or shell companies triangulating money from tax havens to the country matter little.

In fact, international organizations have located the country as a place where the presence of organized crime and the inaction of the authorities make it easier for money to move illegally.

Now, an investigation by MCCI “MEXICANS AGAINST CORRUPTION AND IMPUNITY (MCCI)” reveals that, in 13 years of government, 1,632 inquiries were opened and the Mexican authorities have only managed to sentence 44 people for the crime of operations with resources of illicit origin known as money laundering.

Most got the lowest penalty for this crime, which is five years in prison .

Through requests for access to information made over a year to the Attorney General’s Office (FGR) and the Federal Judicial Branch (PJF), it was found that Mexico has failed in the fight against money laundering.

In the last 13 years, 373 people filed amparos to protect themselves from being accused by the authorities of the crime of resources of illicit origin.

MCCI analyzed the total of amparos and found the reasons why the defendants won in court: lack of evidence and human rights violations are some of the reasons why the cases were dropped.

Through the analysis of these 373 files, various irregularities were found by the police, FIU authorities, as well as the Public Ministry.

Despite the fact that the authorities presumed that the arrests were carried out through financial intelligence actions, MCCI detected that only in 8 cases were investigations initiated for money laundering after conducting a search on their bank accounts.

The cases occurred in flagrante delicto, that is, when the police or elements of the Mexican Army detected that the alleged criminals were carrying a weapon, drugs, or bundles of bills. Similarly, alleged criminals were arrested at the Mexico City International Airport when they passed their suitcase through the security band. Most of the cases were women who carried amounts between 80 thousand and 500 thousand dollars.

The amparos reveal that there were at least three patterns by which the cases were dropped in court: the Public Ministry failed to prove the crime; there were irregularities during the detention; and in others, violations of their human rights were committed, such as torture and illegal detention.

To understand the reasons for the failure against money laundering, MCCI interviewed Santiago Nieto, the current head of the Financial Intelligence Unit (UIF), on March 13.

According to the official, corruption within the Public Ministry, the collusion of judges with organized crime, and the inexperience in criminal matters of the previous administrations of the FIU were the reasons why there is this rate of impunity.

The new administration has been characterized by filing complaints with the FGR. Even so far this six-year term, the FIU has already equaled the number of complaints (around 200) to the entire period of Felipe Calderón’s government, in which there was a frontal attack, at least in speech, against drug trafficking groups.

The effectiveness of these complaints still does not make a difference in the number of people prosecuted for these crimes, but Santiago Nieto dissociates himself from the few results and accuses the public ministries.

“Corruption in the matter of the Public Ministry occurs in the matter of non-exercise of criminal action. Just as in the judges it occurs when they grant protection with weak criteria. In the case of magistrate Isidro Avelar (…) the anti-corruption prosecutor’s office had the arrest warrant. He had 50 million in his account more than what the CJF had to pay, and he was the one that granted the amparos to the Menchito, the Sinaloa cartel and the Jalisco cartel. And other magistrates who are in the same logic. When something does not sound reasonable it sounds metallic, it is what must be verified in judicial decisions and in ministerial decisions, “he declared in an interview.

According to the head of the FIU, another factor that has influenced the crime of money laundering going unpunished is the little experience in criminal matters of the other administrations of said investigation unit. In other words, although financial analysis of the accounts was carried out, this did not make it a judicial process.

One of the problems in prosecuting money laundering, explains Nieto, is that you have to prove a prior crime: “In other words, it accredits trafficking and they no longer care about the issue of money.”

The FIU has two ways of starting an investigation: by orders of authority and those derived from bank reports. The number of the latter is of such magnitude – in 2018 alone there were more than a million – that a risk model from 0 to 10 is used to gauge the importance of the cases.

For example, if a young person of 18 years receives millions of pesos in his account, the bank must turn on the alert and prepare an unusual operation report, or when an operation is made above 10 thousand dollars an operation report is raised relevant. In addition to these, the UIF also receives reports of purchases and movements in real estate, jewelry, even casinos.

“For example, the Mayo sisters (Zambada) won several months a million or two million pesos in casinos, which does not make sense, it was obviously a mechanism that they paid via the casino,” he says.

However, so far in the administration there has not been a case in which a bank alert leads to a judicial investigation.

This also has to do with the capacity with which Mexico processes the reports.

The FIU facilities have the technological infrastructure to receive and order bank reports in real-time, but not enough staff. For example, there is only one actuarial who does the risk analysis. In fact, in an interview, Nieto accepted that the banks had complained to the FIU because they did not see concrete results with the reports they delivered.

The leaks to which MCCI had access as part of the worldwide investigation of the International Consortium of Investigative Journalists (ICIJ) are the Suspicious Activity Reports (SAR) prepared by banks operating in the United States.

Source: e-consulta.com, contralacorrupcion.mx